KDB is committed to promoting and disseminating the concept of sustainable development and its promotional activities in local and overseas markets to help its partners and borrowers achieve their development goals (i.e. to reduce poverty, bring prosperity, secure peace, promote democracy, shape globalization in an equitable manner, and engage in environmental and climate protection).

* Click the title to check the detailed information

KDB’s Commitments

- KDB is committed to supporting sustainable and quality growth through helping people and their environment by providing resources, sharing knowledge, building capacity, and forging partnerships in the public and private sectors. KDB believes that sound economic growth, grounded in sustainable private and public investment, is crucial to sustainable development. KDB’s investment and advisory services are developed and delivered in accordance with its mission and operational strategies

- Central to KDB’s development mission are its efforts to carry out investment and advisory activities to enhance the sustainability of public and private sector operations and the markets they work in, and to achieve positive development outcomes. KDB is committed to ensuring that the costs of economic development do not fall disproportionately on those who are poor or vulnerable, that the environment is not degraded in the process, and that renewable natural resources are managed sustainably.

- KDB recognizes that climate change is a serious global challenge and that climate related impacts may impede economic and social well-being and development efforts. Given the importance of the private sector’s role in the reduction of greenhouse gas emissions, KDB will engage in innovative investment and support adaptation measures that promote sustainable investments through the use and development of relevant products, instruments, markets, and advisory services as well as through the adoption of appropriate technologies, processes, and practices in the activities it supports.

- KDB also recognizes the importance of ecosystem services and their role in climate change mitigation and adaptation. KDB will build on its experience in energy efficiency, cleaner production, renewable energy, and carbon markets as well as in the development of GHG accounting and approaches to climate change risk assessment, to produce instruments and develop practices that allow its borrowers to consider climate-related risks and opportunities in their investment decisions.

Corporate Social Responsibility (“CSR”)

For KDB’s activities in relation to the CSR, please see the CSR section in the Annual Report.

International Participations

To reinforce its sustainability activities, KDB has been collaborating with international association and/or has adopted initiatives that are greatly committed to sustainability.

-

KDB signed the United Nations Global Compact (UNGC) in 2007 and since then has published its annual report stating KDB’s achievement in sustainability and social responsibility activities.

-

KDB is a founding member of International Development Finance Club (IDFC) established in 2014 (through the legacy KoFC). KDB is reinforcing its partnership with other financial institutions to collaboratively address international development issues such as green and environmentally friendly infrastructure development and climate finance.

-

KDB engages with the Green Climate Fund as its accredited entity (AE). KDB became Korea’s first AE of the GCF in December 2016. Becoming an AE of the GCF shows that KDB has the ability to manage the GCF’s resources in line with best-practice fiduciary standards for the scale and type of funding sought, as well as the ability to manage environmental and social risks that may arise at the project level.

-

KDB as a member of Equator Principles Association adopts the Equator Principles (January 2017), a globally recognized benchmark for determining, assessing and managing environmental and social risk in bank financed projects. As a first mover in the Korean finance industry to uphold environmental and social safeguards, KDB sets a standard for domestic institutions in promoting sustainable development and corporate responsibility.

KDB recognizes the importance of climate change, biodiversity, and human rights, and believe negative impacts on project-affected ecosystems, communities, and the climate should be avoided where possible. KDB adopted the Equator Principles (EPs) in January 2017 and established operational policies and guideline which set out the Bank's objectives, standards and procedures for managing the environmental and social (E&S) risks for Project-Related transactions in line with EPs.

Objectives of E&S Risk Management

- Ensure that the Projects we finance and advise on are developed in a manner that is socially responsible and reflects sound environmental management practices

- Contribute to delivering on the objectives and outcomes of the United Nations Sustainable Development Goals (SDGs)

Process of E&S Risk Management

-

New Project-Related Transactions

- Determine if the financial product supporting the project is subject to E&S due diligence (Project Finance Advisory Services, Project Finance, Project-Related Corporate Loans, Bridge Loans, Project-Related Refinance and Project-Related Acquisition Finance)

-

E&S Risk Categorization

- Categorize the project into Category A(High Risk), Category B(Medium Risk), Category C(Low Risk)

-

E&S Due Diligence

(in conjunction with credit review)- Conduct compliance review against the EP requirements (commensurate with project’s risk category)

as a part of loan approval process

- Conduct compliance review against the EP requirements (commensurate with project’s risk category)

-

Financing Documentation

- Incorporate covenants on client’s E&S undertakings into financial documents

-

Monitoring and Reporting

- Client conducts monitoring and reporting to validate continued compliance with the EP requirements

What are the Equator Principles?

-

The Equator Principles is a risk management framework for determining, assessing and managing environmental and social risk in Projects.

The Equator Principles is primarily intended to provide a minimum standard for due diligence to support responsible risk decision-making. It is based on the International Finance Corporation Performance Standards (IFC PS) on social and environmental sustainability and on the World Bank Group Environmental, Health, and Safety Guidelines (EHS Guidelines).

Equator Principles

KDB and the Equator Principles

As the first Korean institution to adopt the EPs, KDB has continued to advocate for wider adoption of the EPs within the local financial community. Specifically, KDB provided official translations of the EPs-III and EPs-IV, which are available on the EPs Association (EPA) homepage. The Bank’s E&S team has also been active in providing advise and sharing experiences with financial institutions contemplating adoption of the EPs.

With growing capacity in E&S risk management, KDB is expanding its engagement in the work of the EPA. Following the official release of the EPs-IV in November 2019, KDB took on the role of "Work Group Lead“ tasked to coordinate the overall transition process from EPs-III to EPs-IV.

KDB's contribution helped Equator Principles Financial Institutions (EPFIs) maintain consistency and robustness of EPs application.

Scope of Application

The Equator Principles applies globally, to all industrial sectors and to the financial products described below when supporting a new Project:

-

Project Finance

Advisory Services- Project Finance Advisory Services where total Project capital costs are US$10 million or more.

-

Project Finance

- Project Finance with total Project capital costs of US$10 million or more.

-

Project-Related

Corporate Loans- Project-Related Corporate Loans (including Export Finance in the form of Buyer Credit) where all of the following three criteria are met:

- i. The majority of the loan is related to a Project over which the client has Effective Operational Control(either direct or indirect).

- ii. The total aggregate loan amount and the EPFI’s individual commitment(before syndication or sell down) are each at least US$50 million.

- iii. The loan tenor is at least two years.

- Project-Related Corporate Loans (including Export Finance in the form of Buyer Credit) where all of the following three criteria are met:

-

Bridge Loans

- Bridge Loans with a tenor of less than two years that are intended to be refinanced by Project Finance or a Project-Related Corporate Loan that is anticipated to meet the relevant criteria described above

-

Project-Related Refinance and

Project-Related Acquisition Finance- Project-Related Refinance and Project-Related Acquisition Finance, where all of the following three criteria are met:

- i. The underlying Project was financed in accordance with the Equator Principles framework.

- ii. There has been no material change in the scale or scope of the Project.

- iii. Project Completion has not yet occurred at the time of the signing of the facility or loan agreement.

- Project-Related Refinance and Project-Related Acquisition Finance, where all of the following three criteria are met:

Equator Principles in Brief

| Principle | Requirement |

|---|---|

| 1. Review and Categorization | EPFI to categorize the project based on the magnitude of its E&S risks and impacts |

| 2. E&S Assessment | Client to address the relevant E&S risks and impacts of the project and propose measures to minimize, mitigate, and offset adverse impacts |

| 3. Applicable E&S Standards | Client to ensure that the assessment process evaluates compliance with the applicable standards, including relevant host country laws, regulations and permits |

| 4. E&S Management System and EPs Action Plan |

Client to develop or maintain an E&S Management System and agree on an EPs Action Plan with the EPFI |

| 5. Stakeholder Engagement | Client to demonstrate effective stakeholder engagement as an ongoing process with the affected communities, and where relevant, other stakeholders |

| 6. Grievance Mechanism | Client to establish a grievance mechanism designed to receive and facilitate resolution of conserns and grievances about the project's E&S performance |

| 7. Independent Review | Independent E&S consultant to carry out a review of assessment documentation in order to assist EPFI's due diligence and assess the project's compliance with the EPs |

| 8. Covenants | Client to incorporate covenants linked to compliance with the EPs |

| 9. Independent Monitoring and Reporting |

Independent E&S consultant to verify the client's monitoring information and assess project's compliance with the EPs |

| 10. Reporting and Transparency | Client to disclose a summary of the assessment documentation and publicly report GHG emission levels EPFI to report at least annuals on its EPs implementation process and experience |

In order to ensure transparency in the implementation of the EPs, KDB reports annually on its EPs transactions following the minimum reporting requirements detailed in the EPs.

Sustainable Financing Framework

-

KDB Sustainable Financing Framework

2025

-

Second Opinion by Moody’s

2025

-

KDB Sustainable Bond Framework

2019

-

Second Opinion by Sustainalytics

2019

-

Environmental

Impact Reporting -

KDB Green Bond Framework

2017

-

Second Opinion by Sustainalytics

2017

Investor Newsletter

-

KDB Investor Newsletter

2025

-

Periodic Review by DNV

2025

-

KDB Investor Newsletter

2024

-

Periodic Review by DNV

2024

-

KDB Investor Newsletter

2023

-

Periodic Review by DNV

2023

-

KDB Investor Newsletter

2022

-

KDB Investor Newsletter

2021

About the Green Climate Fund (GCF)

The Green Climate Fund (GCF) is a multilateral climate fund dedicated to helping developing countries respond to climate change threats by financing their paradigm-shifting actions in the transition towards low-emission and climate-resilient development pathways. Since created in 2010, the Fund has played a valuable role in the global climate finance architecture as an operating entity of the Financial Mechanism of the United Nations Framework Convention on Climate Change (UNFCCC). Headquartered in Songdo, Republic of Korea, it became fully operational in 2015 with unprecedented USD10.3billion mobilized.

Climate-responsive technologies and sustainable solutions are often at the earlier stages in technology development, and are rarely commercially viable. The GCF is an attractive source of climate finance that can fill the financing gap in the new emerging market with technological immaturity and lack of funding. The Fund provides a wide range of financial products including loans, equity, and guarantees to pave the way for private capital to enter the risky emerging market, highlighting potential for scale-up.

Go to the Green Climate FundAccess to the GCF Funds via KDB

The funds of the GCF are accessible via accredited entities approved by the Board consensus. As a GCF accredited entity, KDB can give you access to the Fund’s investment funds which are concessional and virtuous. KDB is the first and only GCF accredited entity in Republic of Korea.

Our professionals with a diverse blend of expertise and industry experience have lined up to best structure bankable investments that address the challenges of climate change in the developing world. The GCF utilizes our executing and financial intermediation capacity as it neither directly implements nor manages projects on the ground.

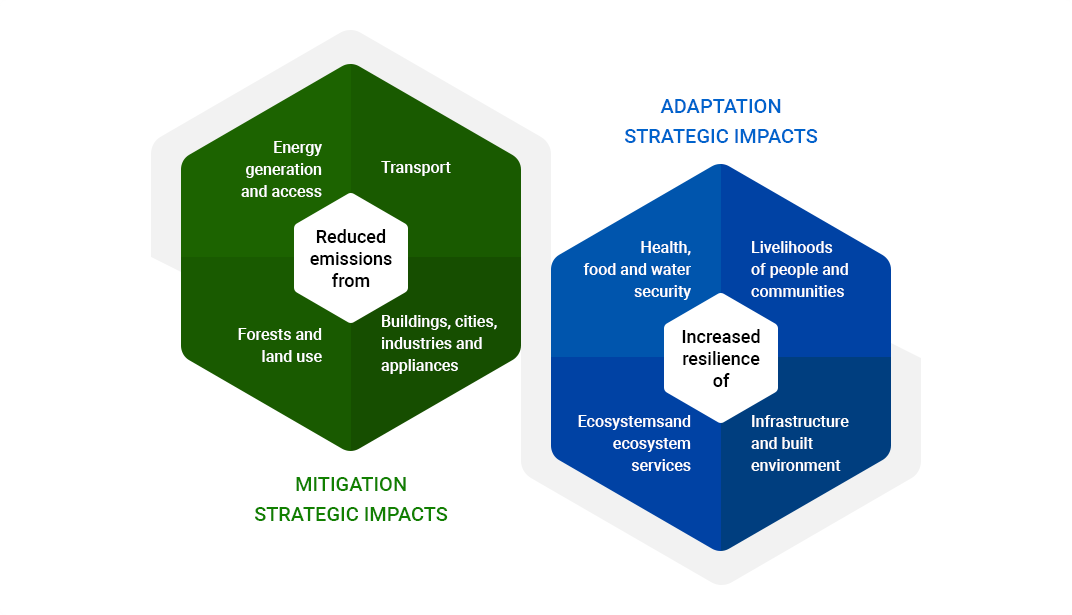

Criteria for Investment Decision

GCF has two funding windows of mitigation and adaptation under which a proposed project ought to focus on at least one results area out of eight. In brief, a proposed project ought to demonstrate the mechanism that results in reduced emissions from energy generation and access, low emission transport, buildings, cities, industries, and appliances, or forestry and land use (mitigation window), and/or in increased climate resilience of vulnerable people and communities, health, food, and water security,

infrastructure and built environment, or ecosystem (adaptation window). All proposed projects are to go through multilayered due diligence conducted by the Secretariat, iTAP (independent Technical Advisory Panel), and board advisors.

Every proposed project further needs to demonstrate that the project is not bankable without concessional GCF funding. The GCF holds the additionality principle that its funds must make a contribution that is beyond what is currently available, or that is otherwise absent from the market. Based on the additionality principle, the GCF provides the minimum concessionality level so as to avoid the crowding-out effect of private sector investment.

The GCF prefers replying on pari passu with a partner accredited entity to being the only risk taker. As an accredited entity, KDB presents funding proposal to the GCF Board that fits into KDB risk appetite as well as the GCF investment priorities. KDB invests in a project under USD250million classified as E&S Category B or C. Our financing combined with the GCF co-financing will deliver greater climate benefits and other co-benefits for our clients and partners.

Disclosure of Environmental and Social Information

We disclose environmental and social information of projects co-financed by the GCF. The early disclosure of potential climate investments takes place prior to the relevant Meeting of the GCF Board in pursuit of transparency, accountability, and participatory development. The disclosure period of E&S Category A projects is 60 days, for Category B projects is 30 days prior to consideration by the GCF Board of 24 members. Please find the disclosed information here. (Go to Project Finance Menu)

In accordance with the GCF Information Disclosure Policy, KDB discloses environmental and social information of projects co-financed by GCF.

| No. | Category* | Project Name | Location | Environmental and Social Information |

|---|---|---|---|---|

| 1 | B | Supporting Innovative Mechanisms for Industrial Energy Efficiency Financing in Indonesia with Lessons for Replication in other ASEAN Member State | Indonesia | ESMS(English) ESMS(Local language) |

| 2 | B | Cambodian Climate Financing Facility | Cambodia | ESMS(English) ESMS(Local language) |

| 3 | B | Collaborative R&DB Programme for Promoting the Innovation of Climate Technopreneurship | Cambodia Indonesia Lao PDR Philippines Vietnam |

ESMS(English) ESMS(Khmer) ESMS(Bahasa) ESMS(Lao) ESMS(Vietnamese) |

*The Categories are

- Category A : Activities with potential significant adverse environmental and/or social risks and impacts that, individually or cumulatively, are diverse, irreversible, or unprecedneted

- Category B : Activities with potential significant adverse environmental and/or social risks and impacts that, individually or cumulatively, are few, generally site-specific, largely reversible, and readily addressed through mitigation measures

- Category C : Activities with minimal or no adverse environmental and/or social risks and/or impacts

Guidelines for Coal Financing

Dedicated to the Paris alignment of finance and overarching climate actions, the Korea Development Bank (KDB) has set out a new ambition to become a Climate Bank which will contribute to a low-carbon and climate-resilient transformation of the Republic of Korea and its global partners, under the strategic implementation of the Guidelines for Coal Financing (Guidelines).

THE GUIDELINES

-

GUIDELINE 1. Financing for Coal-fired Power Plants

- KDB will not finance new coal-fired power projects.

- KDB shall provide transition finance (Carbon Finance Programme) to companies with coal-fired power generation capacity, for their transition purpose (e.g., business/fuel transition, CCUS installation).

-

GUIDELINE 2. Financing for Coal Related Industries

- When it comes to a new credit exposure to coal related industries (mining, import, and transportation), the Department in charge of ESG and sustainable management will pre-review the companies’potential capacity and willingness to move towards a green transition, prior to a credit approval.